Broker Features

Overview of functions for insurance brokers

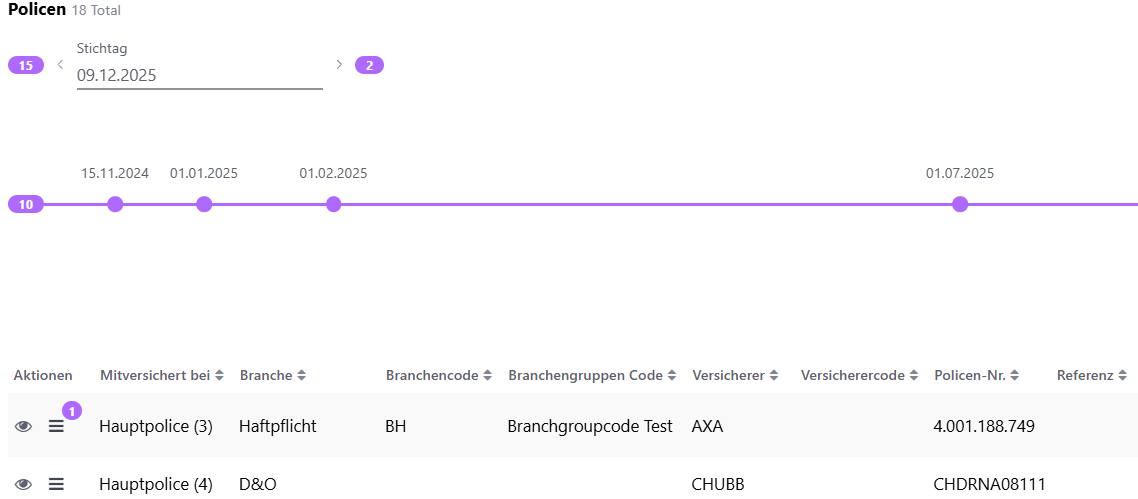

Policy management

This is the control centre of every insurance broker. BAYO offers policy management with historisation, so you can also record changes in the future and view previous versions on a timeline. Individual detail fields are possible, as are co-insured companies. Documents, notes and tasks can be created and stored on the policy.

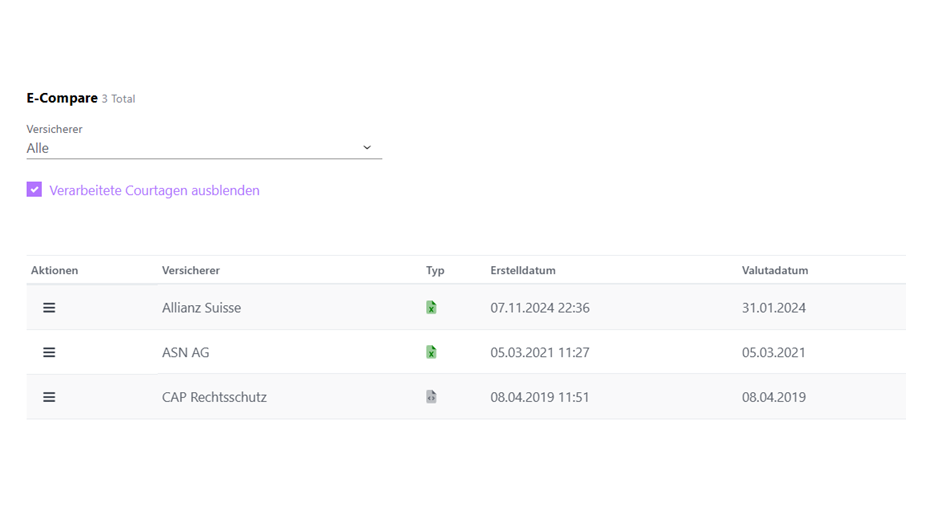

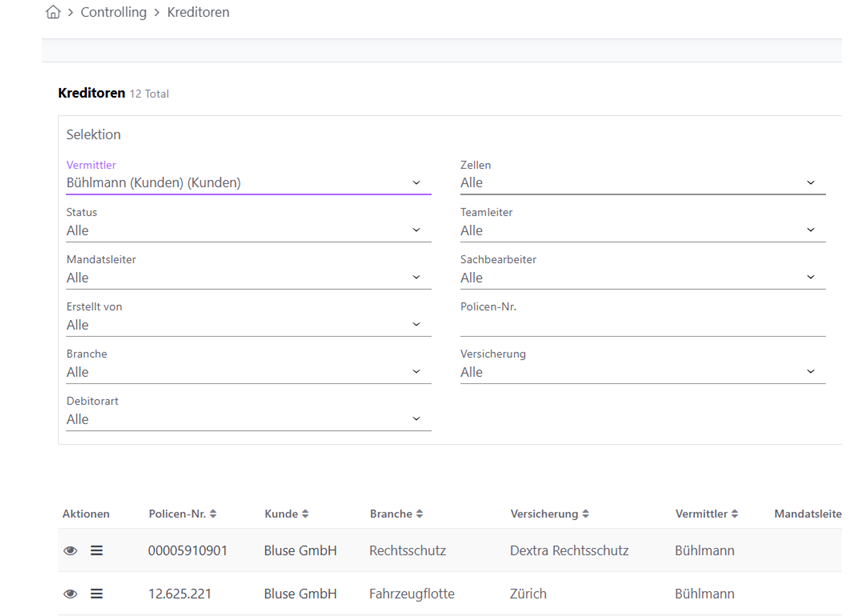

Brokerage fee control

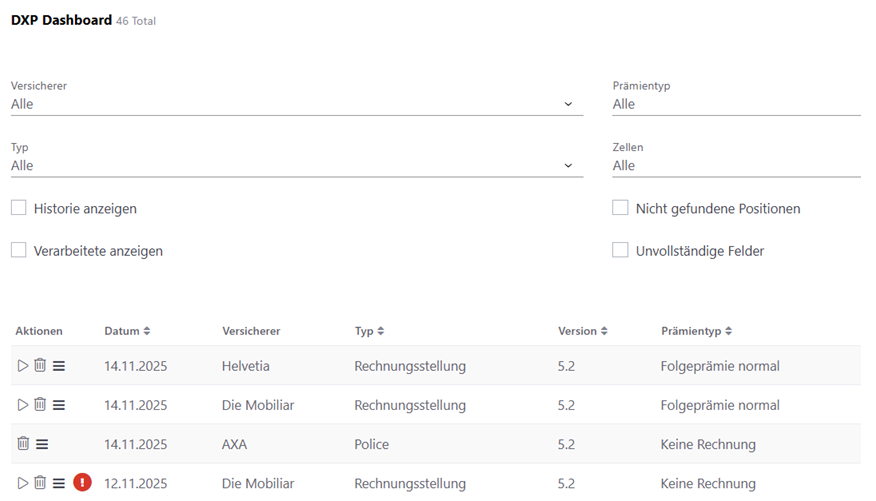

Use the additional module Courtage Comparison to easily keep track of all incoming payments and obtain accurate income data. When processing XML from DXP or after uploading Excel statements, the system proactively alerts you to changes or potential errors and offers a correction or manual assignment. On-account bookings are also possible. In addition to monitoring incoming payments, various reports such as profitability statements per customer and FINMA reporting are also possible after reconciliation.

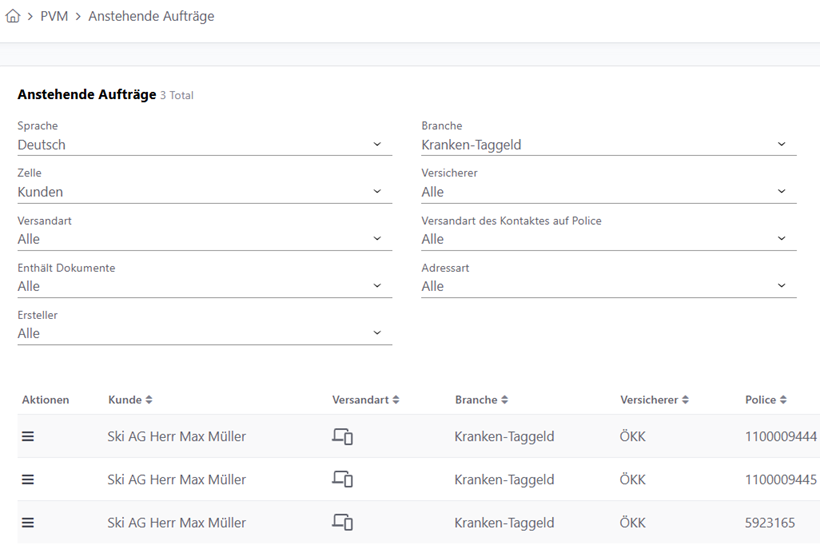

Invoice dispatch

Our Premium Shipping Manager (PVM) is your assistant during the stressful times of the year. Check premium invoices from DXP or other digital sources easily and efficiently without missing any incorrect invoices. To send invoices, select the desired premium invoices and send them to customers in the desired format. Make PDF invoices available to your customers at the touch of a button in the portal, or have BAYO create an email or accompanying letter. You decide how and when the process is started in your company.

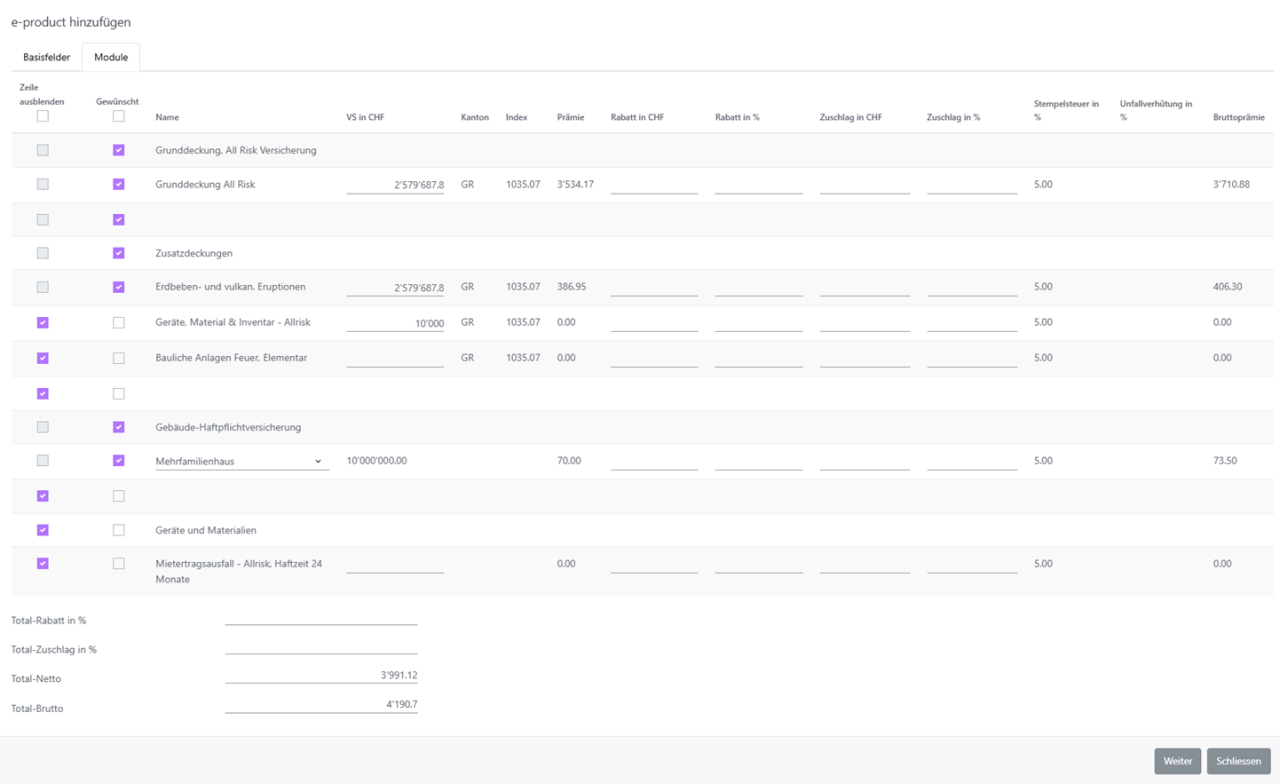

Rate calculator

Enter the basic information, select the coverage modules and create quotations, policies or premium invoices in no time at all. BAYO can also calculate multiple variants, handle tariffs, stamp duty or VAT, carry out cancellations and create evaluations. Finally, the policy and premium documents are also stored in your own BAYO policy management system and can be used for further processing.

Broker and client manager commissions

Is an employee or agent entitled to a share of the brokerage fee or closing commission? No problem with BAYO. Once the brokerage fee (debtor) has been posted, the system automatically creates an agent statement (creditor) based on the agent commissions you have defined or lists the necessary employee commissions.

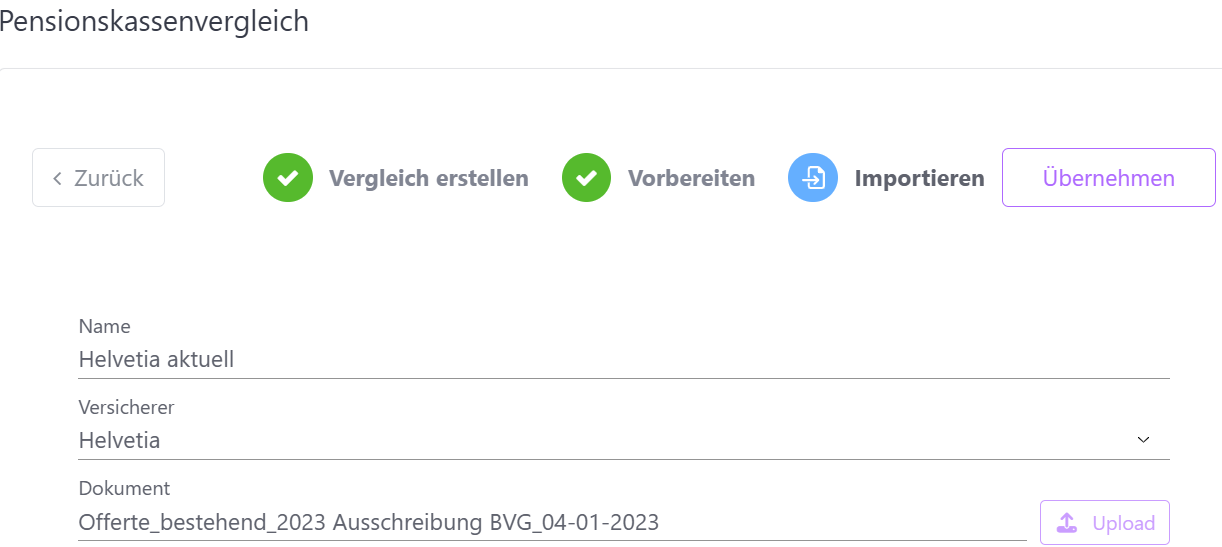

Occupational Pensions Act Settlement

The entire tendering and comparison process is fully integrated into the BAYO Project Manager. You import the initial situation or the offers, make adjustments to the plan and document the tender. BAYO provides you with a detailed comparison of the benefits and costs per insured person. Adjustments can also be made if revised offers are available or if additional pension funds are to be added to the comparison.

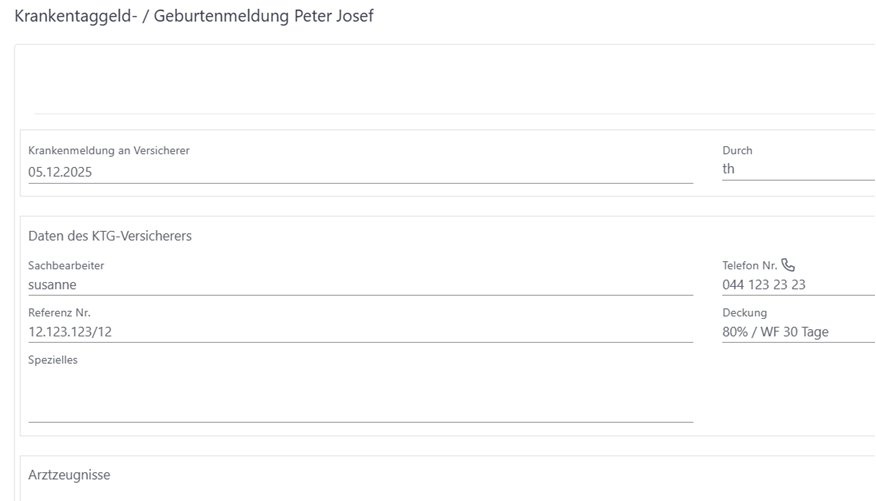

Claims, case management & SUNET connection

Your customers submit claims directly to your BAYO via the BAYO portal or the BAYO app. Your employees can check and validate the data and monitor and track further processing depending on the type of claim using predefined case management data. For personal insurance, most insurers also offer a direct connection or interface via Claimsreport (SUNET). This allows data and medical certificates to be transmitted digitally without media discontinuity. The case is created simultaneously at the insurer and the claim number is stored directly in BAYO.

Ecohub (IGB2B) interface

Rely on industry interfaces and standard processes and receive available documents (e.g. premium invoices, policies, brokerage statements) with metadata directly in your BAYO for further processing in brokerage reconciliation and for sending premiums to your customers. BAYO is a long-standing member of IGB2B and partner of Ecohub AG and shares the idea of end-to-end digital processing in the brokerage business.

Broker Plus

Are there any features missing? Perhaps the Broker Plus package (from CHF 495/month) is right for you!

- Business areas

- Role model for user authorisations

- Compensation models including reporting (excluding invoicing)

- Master data per cell, individual mandatory fields Address

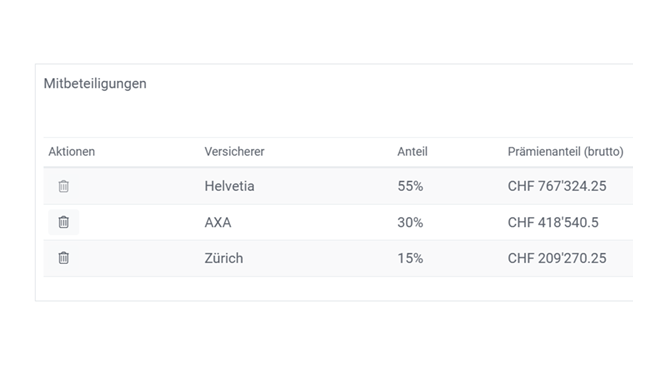

- Co-participation in policies

- Absence management

- More features coming soon